Fully Recover Your Losses

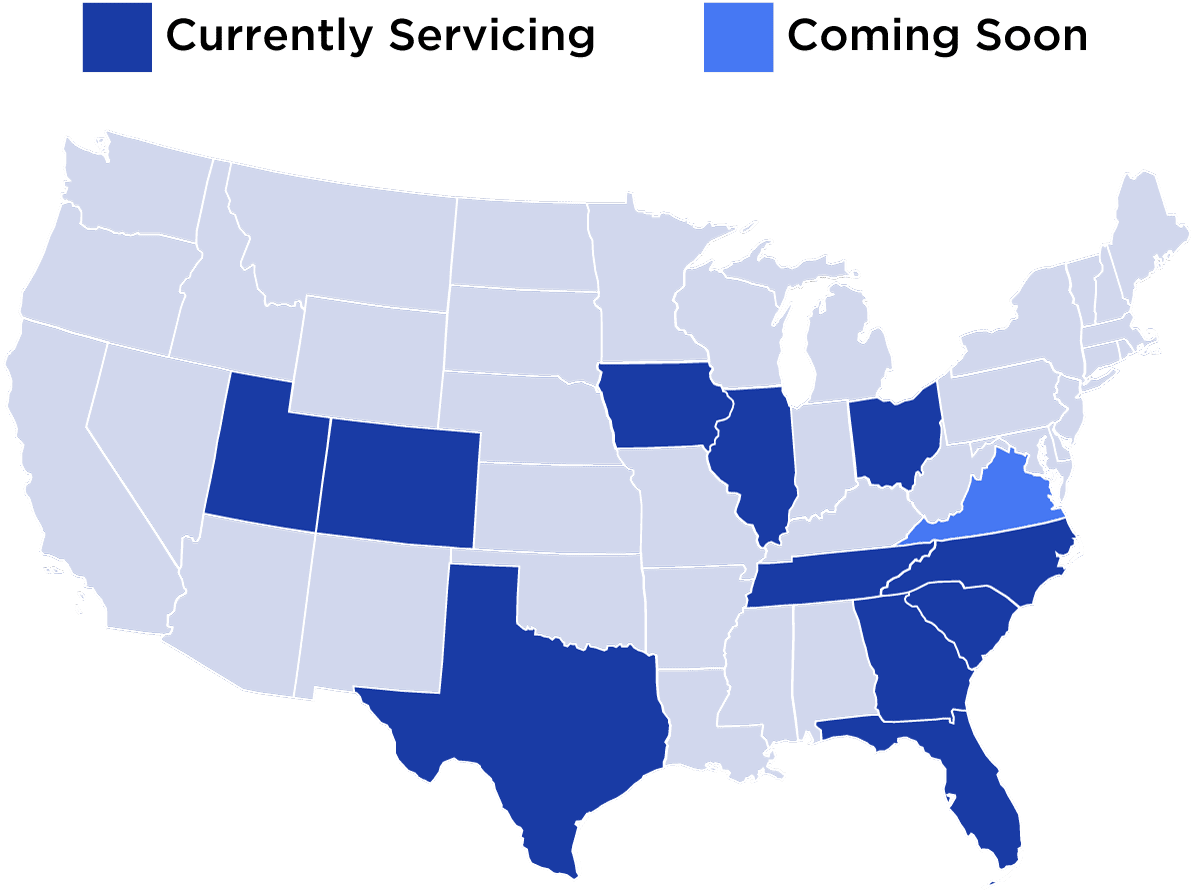

Many property owners that negotiate a significant loss with their insurer themselves without consulting with an Atlanta public adjuster first will find it much more difficult to win enough settlement compensation to fully recover to pre-loss conditions or even better.